The global semiconductor market demand is strong

Chips, known as the "food" of industry, play a very important role in industrial manufacturing.

According to the research, from 2001 to 2023, global semiconductor sales climbed from $139 billion to $526.9 billion, with a compound annual growth rate of 6.0% during the period. This growth trend not only highlights the strong drive of technological progress on chip demand, but also reflects the gradual release of consumption potential in emerging markets such as Asia, Latin America and Eastern Europe. In the Asia-Pacific region, demand from China is extremely strong, accounting for 29% of the global semiconductor market.

Looking ahead, the global semiconductor market will continue to grow. According to the World Semiconductor Trade Statistics (WSTS) forecast, global semiconductor sales are expected to increase to $588.4 billion in 2024 and $654.7 billion in 2025, and the global semiconductor market will continue to grow in the future. The latest data from SIA shows that the chip market in the Americas region performed outstandingly, with an average sales of $14.77 billion in the three months of June, a year-on-year increase of 42.8%, which serves as a reference data for the second quarter of 2024, and the Americas region has maintained excellent growth in 2024. While the Asian chip market growth declined slightly, China still increased by 21.6% year-on-year, and the Asia-Pacific region (excluding China and Japan) increased by 12.7% year-on-year.

China's chip industry is facing severe challenges

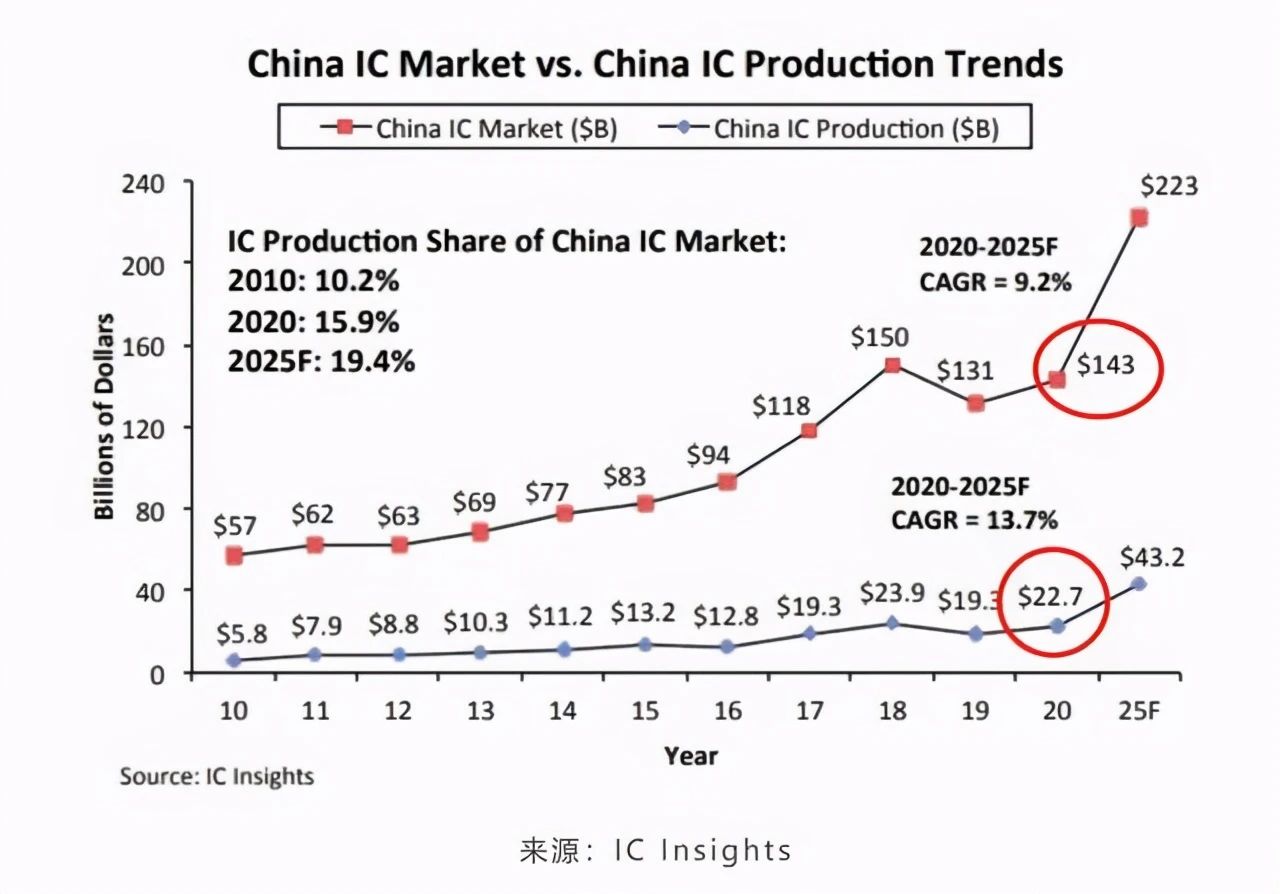

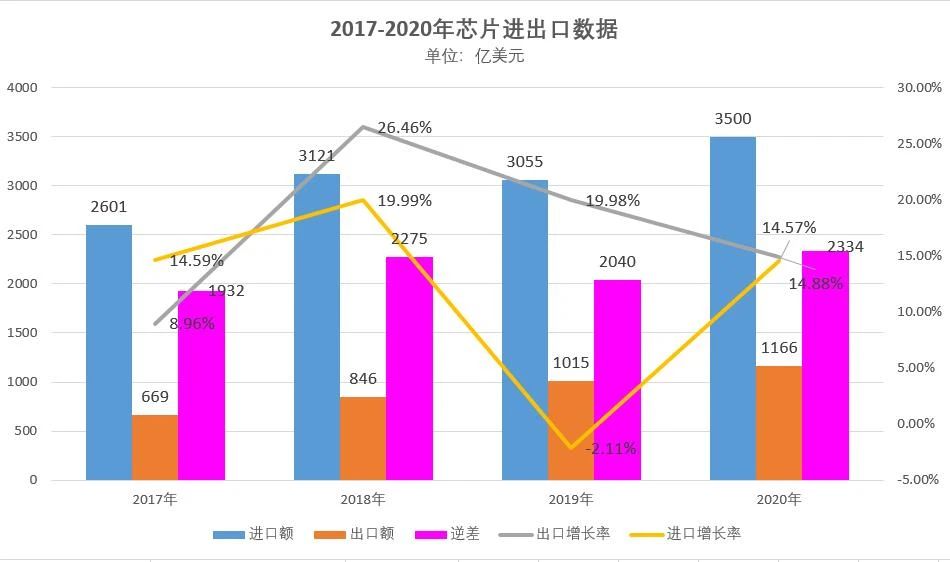

According to the above data, it can also be intuitively seen that China, as a major manufacturing country, has the world's largest chip application market, and the growth rate is rapid. However, the domestic chip industry has the problem of dependence on imports, especially United States high-end chips. This dependence is mainly reflected in cutting-edge technologies such as high-performance computing and artificial intelligence, among which the United States, with its leadership in chip design, core IP and EDA, has formed an important technology input to China.

China's imports of integrated circuits are huge, with imports reaching $304.1 billion in 2019, while the share of domestic chips in the global market is only 10%. This dependence not only increases the cost of domestic enterprises, but also may have an impact on national information security and industrial security. In addition, dependence on foreign technology restricts the development of domestic enterprises in the high-end market and reduces their competitiveness.

For example, after the recent acquisition of VMware, the chip giant Broadcom has seen a sharp increase in the price of its products, even by 1,000%, while customers who have been using its products for a long time have no choice but to continue to buy because they cannot find alternatives in a short period of time. Leave long-term customers with their products vulnerable to supply chain instability.

The long-term import dependence of the domestic chip industry has a significant impact on the cost and the stability of the supply of the industrial chain. High import costs and uncertainty in the international trade situation increase the risk of supply disruptions, which could have a serious impact on domestic chip-dependent industries. Therefore, strengthening the development of the domestic chip industry and improving independent R&D and production capacity are essential to ensure the stability and security of the domestic industry.

Due to the export controls imposed on China by United States and its allies, China is ramping up imports of semiconductor equipment to ensure the security of the supply chain and promote investment and stocking by domestic semiconductor companies.

At the same time, in the field of low-end chips, China's traditional chips have an irreplaceable position in the global market.

China's traditional chips play an important role in the global market, especially in areas with high demand for mature technology chips, such as the automotive industry. According to ASML CEO Christophe Fouquet, although China lags behind the United States in chip technology by about 10 years, the global market is increasingly dependent on traditional chips produced in China, especially in Europe, which has a great dependence on China's traditional chip production capacity. Chinese chipmakers' production capacity is expected to increase by 14% by 2025 to 10.1 million wafers per month, accounting for about one-third of total global production.

From the perspective of the entire chip industry, China's chip industry is indeed facing severe challenges and crises.

China's chip industry is showing good momentum

In the process of developing the low-altitude economy, it is inevitable to strengthen the support of low-altitude economic technology and equipment, and promote the construction of digitalization, networking and intelligence.

China's dependence on United States high-end chips has also prompted the domestic industry to accelerate independent R&D and technological innovation. In recent years, Chinese companies are making continuous efforts to improve the technological level and innovation capabilities of their chip industry. For example, Loongson released a domestic CPU, the Loongson 3A6000, whose performance is comparable to Intel's 2020 10th Gen Core quad-core processor. In addition, China is also actively exploring new chip manufacturing processes, such as FD-SOI and Chiplet technology, to achieve technological breakthroughs and industrial upgrading.

With the rise of China's chip industry, the acceleration of domestic substitution and the recovery of the semiconductor industry, many domestic semiconductor companies have performed extremely well in market financing this year.

Data show that in the first half of the year, the performance of the vast majority of China's listed semiconductor companies soared, with 14 companies' net profits increasing by more than 100%, and 6 companies' net profits increasing by more than 5 times.

Among them, the most outstanding performance is China's No. 1 chip design company Weir shares. Weir shares in the first half of the net profit soared 800%, operating income of 12.091 billion yuan, a year-on-year increase of 36.50%, although this performance is not bad but not too exaggerated, really amazing is its profit, the first half of the net profit of 1.367 billion yuan, a year-on-year increase of 792.79%, showing an amazing growth momentum.

With the continuous development of China's chip industry, China's domestic chip companies have made breakthroughs in many fields and are gradually improving their competitiveness in the global semiconductor industry. With the advancement of technology and the growth of market demand, it is expected to occupy a more important position in the global semiconductor industry. The future development of China's chip industry is worth looking forward to.

Related information

-

Wechat

-

Phone

18928454078 -

Tiktok