Recently, Infineon opened the first phase of the world's largest 8-inch silicon carbide (SiC) power semiconductor wafer fab (Fab 3) in Kulim, Malaysia, which will produce wide bandgap semiconductors represented by silicon carbide and gallium nitride, and is expected to start mass production in 2025.

According to the Commodity Intelligence Quarterly (CIQ) report, the CIQ demand index for power devices bottomed out, the overall price remained stable, and the delivery cycle continued to decline. This issue will analyze the market demand, price trends, delivery cycles and related enterprise dynamics of power devices in combination with CIQ, and provide the latest information for buyers and sellers of power devices.

Wafer capacity expansion: The price of SiC power devices is expected to decline

In the first half of 2024, the cost of electric vehicles using SiC devices will drop by 15%~20%, while the unit price of SiC has dropped to a level comparable to that of IGBT. Falling prices will lead to faster adoption of SiC components, which is expected to drop by as much as 30-35% by 2025 when 8-inch wafer capacity increases.

In addition to foreign manufacturers such as Infineon and STMicroelectronics increasing the production of 8-inch silicon carbide, domestic manufacturers such as Xinlian Integration, Hunan San'an Semiconductor and Shilan Micro have also begun to increase the production of 8-inch silicon carbide. It is foreseeable that a huge amount of silicon carbide production capacity will be released soon.

With the growth of silicon carbide (SiC) device productivity, technological progress, deepening of domestic production and the realization of economies of scale, the selling price of SiC chips has begun to enter a downward trajectory, bringing significant challenges to the entire industry. According to the analysis of TankeBlue Semiconductor, a Chinese SiC wafer manufacturer, upgrading from 4-inch wafers to 6-inch wafers is expected to reduce the cost of a single chip by 50%; Further expansion from 6-inch to 8-inch wafers is expected to reduce the cost by another 35%.

In addition, after an initial period of price cuts and sluggish demand, the 2024Q3CIQ shows that the overall price of diodes is stable and there is little room for fluctuation. Although the price trend of MOSFETs has been closely following diodes over the past few quarters, there is currently no significant price volatility in MOSFETs, mainly because the market demand for MOSFETs is larger than that of diodes. With copper prices reaching record highs, there is a possibility that the price of high-voltage MOSFETs using copper clips will increase.

Power device inventory increases: lead times decrease

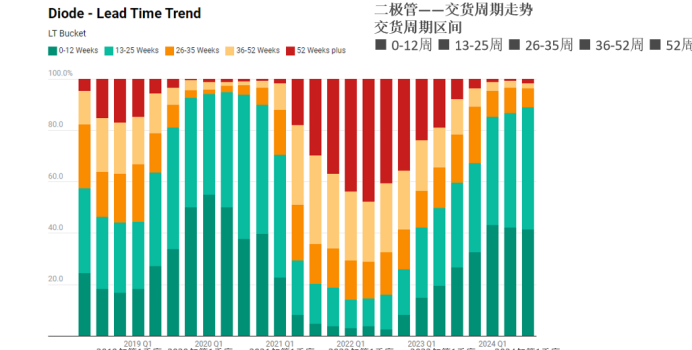

Overall lead times for power devices continue to decline, OEMs and distributors continue to increase inventories, and delays and cancellations of power device orders continue to occur. The lead time of different devices and different manufacturers varies greatly.

With the exception of silicon carbide devices and high-voltage MOSFETs, most power devices will be available flexibly in 2024 with regular delivery cycles. For high-voltage MOSFETs, onsemi has lead times of 12 to 40 weeks, Microchip 30 to 50 weeks, and Infineon 12 to 40 weeks.

onsemi's lead times improved significantly, with only 4% of parts severely constrained; ST's automotive devices have lead times of 30-40 weeks, 52 weeks for SiC MOSFETs, 50-52 weeks for superjunction plane IGBTs, 24 weeks for SBDs, and 18-22 weeks for MOSFETs. The lead time of diodes and transistors can be shown in the figure below (source: CIQ2024Q3).

Downstream market demand is expected to grow

In April 2024, China's new installed capacity of photovoltaic power generation was 14.37GW, a year-on-year decline. According to the National Energy Administration, from January to April 2024, the cumulative installed capacity of photovoltaic power generation in China was 60.11GW, a year-on-year increase of 24.4%; It is estimated that in April 2024, China's new installed capacity of photovoltaic power generation will be 14.37GW, a year-on-year decrease of 1.9%. In March this year, it was rumored in the market that the power grid company would relax the red line of 95% new energy consumption, which is expected to stimulate the growth of downstream installed capacity.

In the first quarter of 2024, global automobile sales will be 8.15 million units, maintaining a growth trend, but the growth rate has slowed down significantly. In March 2024, global automobile sales were 8.15 million units, a year-on-year increase of 0.4%, and from January to March, global automobile sales totaled 20.81 million units, a year-on-year increase of 1.9%; In March 2024, China's automobile sales were 2.69 million units, a year-on-year increase of 9.9%, and the cumulative sales from January to March were 6.72 million units, a year-on-year increase of 10.5%; In the first quarter of 2024, China's auto sales accounted for about 32% of the global market.

Localization process: domestic SiC manufacturers dynamics

On April 20, Xinlian Integration, located in Zhejiang, China, successfully completed the production of 8-inch silicon carbide engineering batches and successfully rolled off the production line. The production line is compatible with the production of 6-inch and 8-inch silicon carbide MOS chips, and is expected to have an annual production capacity of 60,000 pieces when fully put into operation. It marks that the production of 8-inch silicon carbide wafers has officially entered the localization process.

In May, Hunan Sanan Semiconductor announced that the first phase of its silicon carbide project had been fully put into operation, with an annual production capacity of 250,000 pieces (in terms of 6-inch wafers). At present, the second phase of the project is progressing in an orderly manner, and it is planned to introduce 8-inch production equipment and technology, and is expected to start production in the third quarter of this year. The entire project is expected to have an annual production capacity of 480,000 pieces.

In June, Silan Micro started the construction of an 8-inch silicon carbide wafer factory in Xiamen. The project will be constructed in two phases and is expected to have an annual production capacity of 720,000 pieces when fully operational.

Related information

-

Wechat

-

Phone

18928454078 -

Tiktok