At a time when the semiconductor industry is generally blowing cold wind, thanks to the impact of comprehensive factors such as expanding the application field to new energy vehicles and new energy photovoltaics, the power semiconductor track still maintains relatively steady growth and has become an upward field in the contrarian trend.

The power semiconductor market continues to grow and is expected to reach $52.2 billion by 2024. And China, as the world's largest consumer of power semiconductors, contributes about 40% of the power semiconductor market, and will be a domestic IGBT by 2024

The market size will reach $3.5 billion.

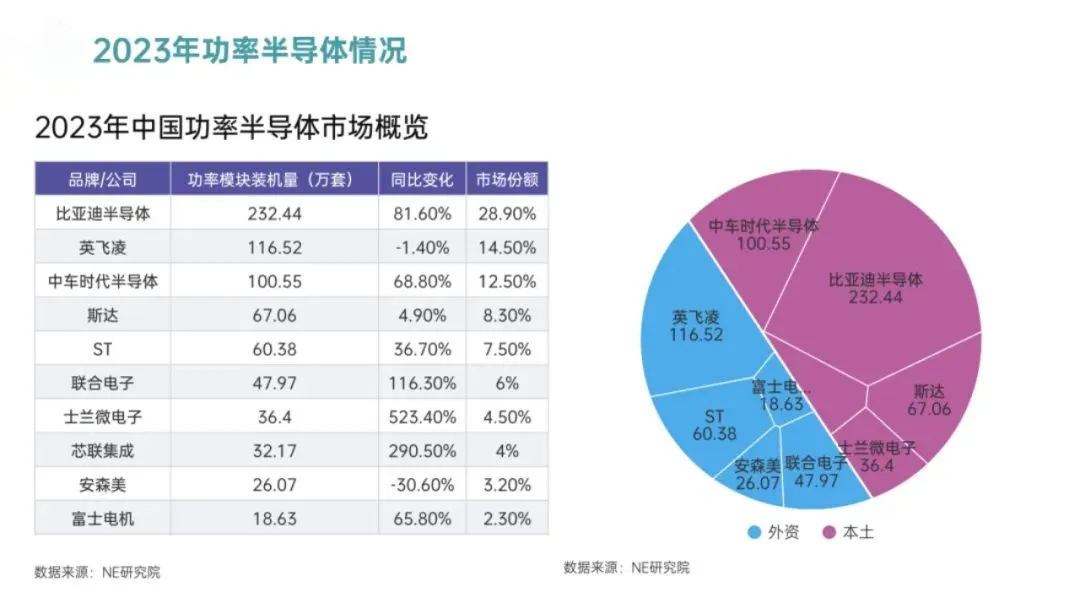

In 2023, domestic substitution will be accelerated, and the proportion of global market share will increase.

In the past for a long time, the power semiconductor market has been firmly dominated by foreign giants such as Europe, the United States, and Japan, and with the development of new energy vehicles in recent years, many local companies have also entered the market and are growing rapidly in various market segments.

From the perspective of the current domestic power semiconductor industry as a whole, China's power semiconductors start from low-threshold subdivision applications, and gradually develop to the application fields where technology is more difficult to achieve, and gradually move towards internationalization with the head manufacturers of new energy going overseas.

Looking at the market, whether it is traditional Si power devices IGBT, MOSFET, or the third generation of semiconductors represented by SiC and GaN, domestic enterprises have layouts.

Not long ago, the China Securities Regulatory Commission disclosed the filing report on the initial public offering and listing guidance of Jiangsu Xin Changzheng Microelectronics Group Co., Ltd. (hereinafter referred to as Xin Changzheng). CICC has been hired as the mentor for the initial public offering and listing of the core long march.

and have signed a "Mentoring Agreement".

Core Long March is a high-tech enterprise integrating the design, R&D and packaging manufacturing of new power semiconductor devices, and its core business includes IGBT, coolmos, SiC and other chip products and technology development, IGBT module design, packaging, testing and foundry, etc.

Only half a year after its establishment, the core Long March completed a Pre-A financing of 15 million yuan. Since then, the core has completed two consecutive rounds of financing in 2018, and maintained a round of financing every year from 2019 to 2021, with a total financing of more than 500 million yuan. At the beginning of 2023,

It has also completed hundreds of millions of yuan in Series D financing, and more than 40 investment institutions behind it have accumulated.

The core long march adheres to the guidance of user needs, and empowers the continuous iteration of power semiconductor products with solid playing methods and outstanding advantages. It has been committed to becoming an internationally influential power semiconductor company.

According to the data, with China's increasing achievements in the field of power semiconductors, especially IGBTs, Chinese semiconductor companies will perform better and better in the field of power semiconductors in 2023, accounting for an increasing proportion of the global market share.

Driven by new energy vehicles

The power semiconductor market continues to be hot

At present, low-carbon production methods and lifestyles are gradually taking shape, and new energy and new energy vehicles are also developing steadily, which continues to drive the expansion of the power semiconductor market.

With the emergence and development of new application scenarios, the application scope of power semiconductors has expanded from traditional consumer electronics, industrial control, power transmission, computers, rail transit, new energy and other fields to emerging applications such as the Internet of Things, electric vehicles, cloud computing and big data.

It is estimated that by 2025, the global penetration rate of new energy vehicles will reach 20%, and China will reach 34%, leading the world. Assuming that after 2021, global automobile sales, including China, will grow slowly at an annual growth rate of 3%, and new energy vehicles will maintain rapid growth, and it is estimated that in 2025, global automobile sales will reach 90.2 million, the penetration rate of new energy vehicles will reach 20%, and the sales volume of new energy vehicles will be 18.04 million; In 2025, China's automobile sales will reach 29.57 million units, of which the penetration rate of new energy vehicles will reach 34%, and the sales volume of new energy vehicles will be 10 million, leading the world.

Power semiconductors are the core of electrical energy conversion and circuit control in electronic devices, mainly used to change the voltage and frequency in electronic devices, DC and AC conversion, etc. Compared with traditional fuel vehicles and mild hybrid vehicles, electric vehicles do not have engines and start-stop systems, but due to the increased requirements for power conversion and control, there are more components such as main electronic control (electric drive), on-board electric air conditioning, DC-DC, OBC, and battery management system (BMS), driving the demand for power semiconductors.

With the iterative upgrading of technology, the development of automotive electrification and intelligence has driven the development of the automotive-grade chip industry, and the value chain of automotive power semiconductors has been reshaped. According to statistics, the global automotive chip market size has a year-on-year growth rate of more than 10% every year, and the global semiconductor market size in 2019 was as high as 412.1 billion yuan, of which automotive semiconductors accounted for 12.3%, and the proportion of automotive semiconductors in the overall semiconductor has been increasing year by year since 2010, and the market scale of the automotive chip industry has been expanding. Global sales of automotive semiconductors are forecast to climb to $67.6 billion in 2026. The rise of new energy vehicles

With the rapid development, China's automotive power semiconductor market will continue to flourish.

2024 for power semiconductors

Usher in a new trend of development

MOSFETs and IGBTs are the main power semiconductor products.

IGBT is in short supply, and Chinese mainland is the main force for expansion

Under the shortage of IGBT production capacity, many companies choose to expand production. It takes three years for a new chip production line to be put into production from the beginning of construction, which is longer than the expansion cycle of most technology products. Most of the 6-inch and 8-inch fabs are depreciated, and few 6-inch and 8-inch fabs will expand IGBT capacity due to cost-effectiveness issues.

Driven by the huge market demand, the shipments of local IGBT companies such as New Clean Energy, Macro Micro Technology, Silan Micro, Star Semiconductor, and Times Electric have increased significantly, and at the same time, they continue to iterate new products.

Low- and high-voltage MOSFETs will be further differentiated

In the future, the low- and high-voltage MOSFET market may be further differentiated. The medium and low MOSFET technology is relatively mature, and the market entry threshold is low. With the rapid development of the end market, the surge in downstream demand will continue to push more manufacturers to pour into the field of medium and low voltage MOSFETs, and the market competition will become more and more fierce.

On the other hand, the high-voltage MOSFET market is expected to continue to grow. According to Omdia, the market size of global/Chinese high-voltage superjunction MOSFET products was US$9.4/420 million in 2020 and will reach US$10/US$440 million in 2024. With the growth of demand in the downstream high-voltage field, high-voltage MOSFETs will increase their market share. According to Yole data, automobiles will become the largest incremental market for MOSFETs, accounting for more than 30% of the MOSFET market share by 2026, thereby driving the growth of the high-voltage MOSFET market. Among them, electric vehicles and charging piles accounted for 25% and 8% respectively.

SiC, speed up the boarding

Among the models that have been launched, most of the 800V fast charging technology is only "standard" on the higher version models, while the entry-level or low-to-mid-range models still use the 400V battery pack. But this year, a number of models equipped with the 800V platform have been released, including Nezha S, Xiaomi MS11, Zhiji LS6, AVATR 12, Li MEGA, and Polestar 5.

Therefore, with the release of models with 800V platform, silicon carbide will usher in greater demand. In 2024, SiC will be put on the car at an accelerated pace, and with the further expansion and construction of factories, SiC production capacity will become increasingly sufficient.

The application prospects of power semiconductors are broad, covering almost all electronic industry chains. In recent years, with the rapid development of the domestic electronics manufacturing industry, especially the continuous expansion of new energy vehicles, wind power, photovoltaics, rail transit and other fields, the power semiconductor market has grown significantly. The expansion of the market scale has brought more development opportunities to the industry.

Related information

-

Wechat

-

Phone

18928454078 -

Tiktok