In 2024, China's semiconductor industry will gradually show a recovery and growth trend after a long period of market adjustment. At present, the overall domestic macro economy has stabilized and rebounded, the downstream demand market has been boosted to a certain extent, and the market attention in the fields of artificial intelligence, XR and consumer electronics has been increasing.

In the first half of 2024, although the amount of investment in the domestic semiconductor industry decreased year-on-year, it also released a signal that the market tends to be rational. In addition, the acceleration of the construction of domestic wafer factories has brought growth momentum to domestic semiconductor equipment and materials, and the domestic semiconductor industry will continue to develop upward in the future with technological innovation breakthroughs and domestic substitution.

According to CINNO Research statistics, the investment amount of China's semiconductor industry projects from January to June 2024 reached 517.3 billion yuan (including Taiwan, China), a year-on-year decrease of 37.5%.

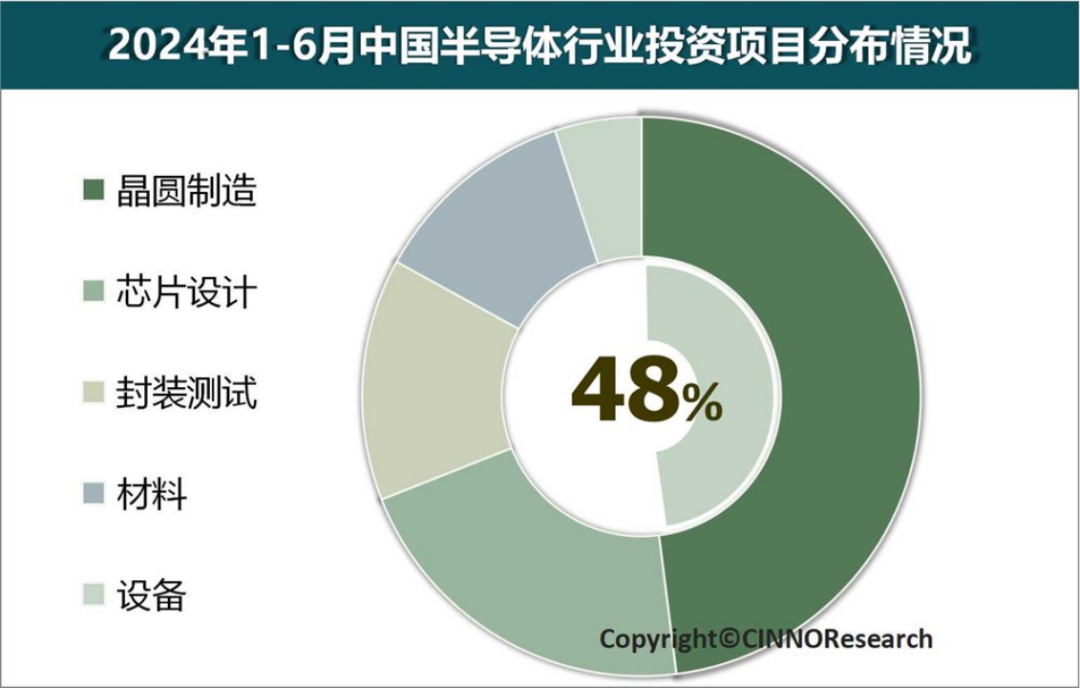

From January to June 2024, the investment funds in China's (including Taiwan, China) semiconductor industry mainly flowed to wafer manufacturing, amounting to about 246.8 billion yuan, accounting for about 47.7%, down 33.9% year-on-year; The investment in chip design was RMB110.4 billion, accounting for about 21.3%, down 29.8% year-on-year. the investment in semiconductor materials was 66.81 billion yuan, accounting for about 12.6%, down 55.8% year-on-year; the investment in packaging and testing was 70.19 billion yuan, accounting for about 13.6%, a year-on-year decrease of 28.2%; The investment in semiconductor equipment was 24.66 billion yuan, accounting for about 4.8%, a year-on-year increase of 45.9%.

From the perspective of the geographical distribution of semiconductor industry investment, a total of 23 provinces and cities (including municipalities directly under the central government) are involved, of which Taiwan and Jiangsu provinces account for more than 10% of the investment funds; The top five regions in terms of investment funds accounted for about 78.6% of the total; From the perspective of the distribution of domestic and foreign capital, domestic capital accounted for 90.9%, and Taiwan capital accounted for 9.1%.

Subdivided into the field of semiconductor industry materials, according to CINNO Research statistics, from January to June 2024, China's (including Taiwan, China) semiconductor industry investment funds accounted for the highest proportion of silicon wafer investment by project category, accounting for about 48.9%, with an investment amount of 32.73 billion yuan; Sic/Gan investment accounted for about 16.9%, with an investment amount of 11.35 billion yuan.

Overall, with the gradual return of semiconductor product inventory to a reasonable level, the gradual recovery of terminal market demand, especially the increase in semiconductor demand in the fields of smart phones, servers, automobiles and PCs, as well as the rapid development of AI, the Internet of Things, etc., the global semiconductor industry will gradually recover and re-enter the development channel of steady growth.

Investment in China's semiconductor industry in the first half of 2023 In the first half of 2023, the volatility of the Philadelphia semiconductor index rebounded, and after May, driven by factors such as the sharp increase in Nvidia's performance, the growth rate of the Philadelphia semiconductor index rose, and the index value reached about 3,861 points in July. The rebound of the Philadelphia semiconductor index has played a positive role in guiding the recovery of the global semiconductor industry and industrial investment to a certain extent. According to CINNO Research statistics, the investment in semiconductor projects in China (including Taiwan, China) from January to June 2023 was about 855.3 billion yuan, down 22.7% year-on-year, and the global semiconductor industry is still in the destocking stage.

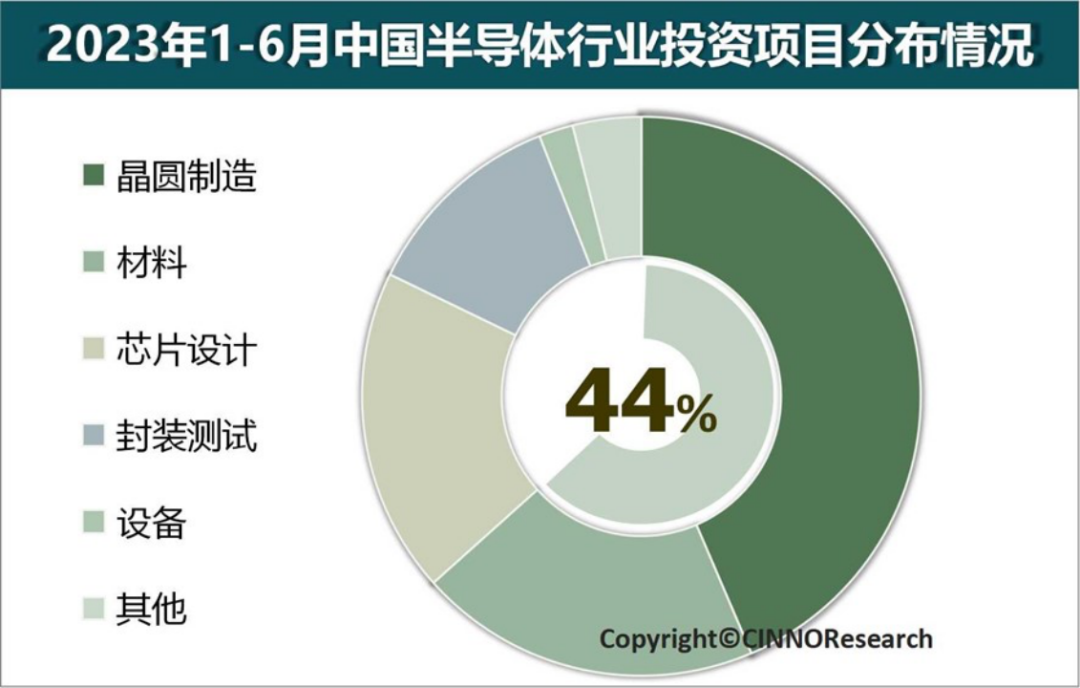

Segmentation of funds in the semiconductor industry: In the first half of 2023, investment funds in the semiconductor industry in China (including Taiwan, China) mainly flowed to wafer manufacturing, amounting to about 373.1 billion yuan, accounting for about 43.6%;

The total investment in semiconductor materials amounted to approximately RMB171.5 billion, accounting for approximately 20.1%; The total investment in chip design was approximately RMB161.6 billion, accounting for approximately 18.9%; The total investment in packaging and testing exceeded about 98 billion yuan, accounting for about 11.5%;

The total capital investment was about 16.9 billion yuan, accounting for about 1.9%. In the first half of 2023, from the perspective of geographical distribution, the distribution of semiconductor project investment funds in China (including Taiwan, China) is mainly in Taiwan, Jiangsu and Zhejiang, and the overall proportion of the three regions is about 66.9%. Silicon wafers, third-generation semiconductor materials and electronic chemicals are the three main silicon wafers in the field of semiconductor materials, and third-generation semiconductor materials and electronic chemicals are the three major investment areas of semiconductor materials this year.

In the first half of 2023, China's (including Taiwan, China) semiconductor materials funds will mainly flow to silicon wafers, amounting to about 56.6 billion yuan, accounting for about 32.9%; The total investment in third-generation semiconductor materials is about 26.7 billion yuan, accounting for about 15.6%; The total investment in electronic chemicals was about 16.8 billion yuan, accounting for about 9.7%.

China's semiconductor industry as a whole is showing a recovery trend, but with the changes in the industrial environment, this recovery is also complex.

In the past two years, domestic semiconductor investment and financing have continued to decline. In the first half of this year, the investment in semiconductor equipment, which accounted for only about 4.8% and amounted to 24.66 billion yuan, increased by 45.9% year-on-year, becoming the only category of growth in this statistics. And as recently as August 26, the latest statistics released by the General Administration of Customs of China confirm this increase.

According to the data, in the first seven months of 2024, China imported 36,000 sets of semiconductor manufacturing equipment, an increase of 17.1% compared with last year, reaching 163.86 billion yuan (US$23.05 billion), a year-on-year increase of 51.5%. The narrowing of investment accompanied by the still rising investment in industrial equipment has made the characteristics of this round of the cycle of China's semiconductor industry show a bit of "contradiction".

Behind the tightening of the layout of the capital, whether the industry is returning to benign development or lowering market expectations because of the weak recovery has become the focus of a new round of attention from all parties. China's semiconductor industry has been releasing positive signs. In the first quarter, the International Semiconductor Industry Association (SEMI) predicted that China's wafer production capacity growth rate will reach 13% in 2024, leading the world, and the annual production capacity will increase from 7.6 million to 8.6 million pieces.

Subsequently, in June this year, data released by the World Semiconductor Trade Statistics Organization showed that China's semiconductor sales increased by 21.6% to $15.09 billion that month. In contrast, this also confuses the market with the "not very good" investment data. In this regard, He Hui, director of research of Omdia semiconductor industry, pointed out that the decline in industrial investment is not contradictory to recovery, and in recent years, the development of domestic semiconductors has entered a new stage of integration, and it is very normal for capital to decline at the scale level. "It has been 10 years since the release of the "National Integrated Circuit Industry Development Promotion Outline" in 2014, during which all kinds of social capital from the state to the local government are more enthusiastic about the semiconductor industry, but since last year, the country has released some more obvious signals in policies and actions, announcing that the semiconductor industry is entering a period of integration."

He Hui said that the establishment of the third phase of the fund is a landmark node. Luo Guozhao, director of the China laboratory of the CHIP Global Test Center, said that in his view, the decline in investment scale is mainly affected by two reasons: active and passive. On the one hand, at the level of semiconductor products and mature markets, China has actually completed the basic layout and entered a stable stage in the past few years, which makes the role of large-scale investment in the early stage have ended, so the decline in investment volume at this active level is in line with expectations. "

On the other hand, due to the current demand for the main consumer products of semiconductors are declining, the market's demand for global wafer volume is also decreasing sharply, except for a few AI leaders are still pulling, the global semiconductor consumption capacity is very limited, at this time for the entire market, the demand for capital market investment will decline." Luo Guozhao said.

Related information

-

Wechat

-

Phone

18928454078 -

Tiktok